Buying Stock on Margin Definition

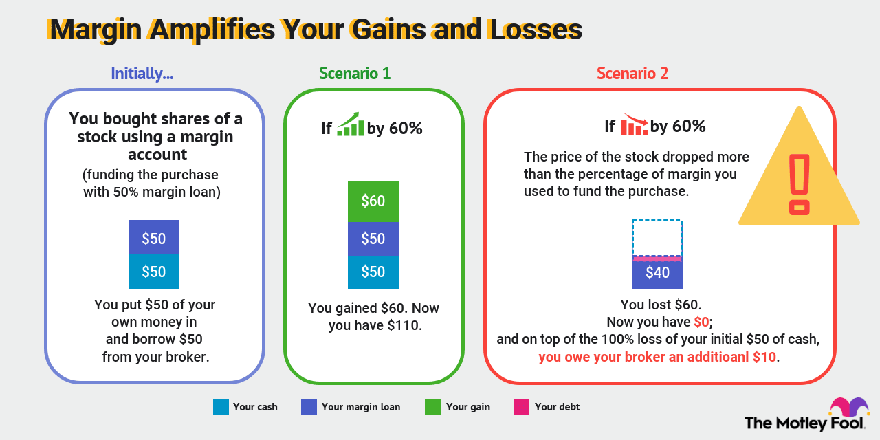

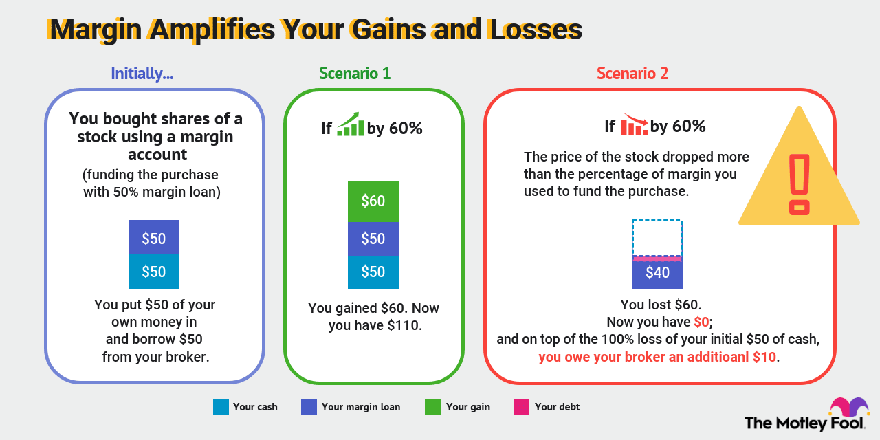

To open a new brokerage account and request a margin loan call this toll-free number to open by phone 866-243-0931. Margin can magnify profits when your stocks are going up.

Benefits Of Margin Trading Margin Leverage Effect

But they can also magnify losses and in.

. Margin trading or buying on margin means offering collateral usually with your broker to borrow funds to purchase securities. Investors that have never traded on margin before should consult with a. Get started today with Robinhood Financial LLC.

Ad Trade stock options commission-free. Buying Stocks on Margin Definition. Trusted platform with 22M users.

Ad Increase Your Buying Power And New Strategies With Margin At TD Ameritrade. You get the rest of the money by borrowing it from your broker. Stock Trading Tutorials - Stock Trading Guide 2022 - Become Stock Trader Quickly 2022.

Buying on margin therefore is a practice of investing into assets using margin a borrowed amount of money. In general buying stocks on margin is a bad idea. Imagine again that you used.

Buying on margin is borrowing money from a broker to purchase stock. This costs a little extra because brokers charge interest when. They act as leverage and can thus magnify gains.

You can think of it as a loan from your brokerage. Stocks Mutual Fund Investments. Buying stock on margin is similar to buying a house with a mortgage.

The loan is collateralized by the stocks themselves. You could lose all your initial investment if the stock suddenly. Setting up a Margin Account at Wells Fargo Advisors.

Start Growing Your Savings With Research Tools Provided By These Top-Reviewed Brokerages. The greatest advantage to buying on margin is that it boosts your purchasing power. Ad Become Stock Trader 100 - Learning Stock Trading Quick FREE Updated 2022.

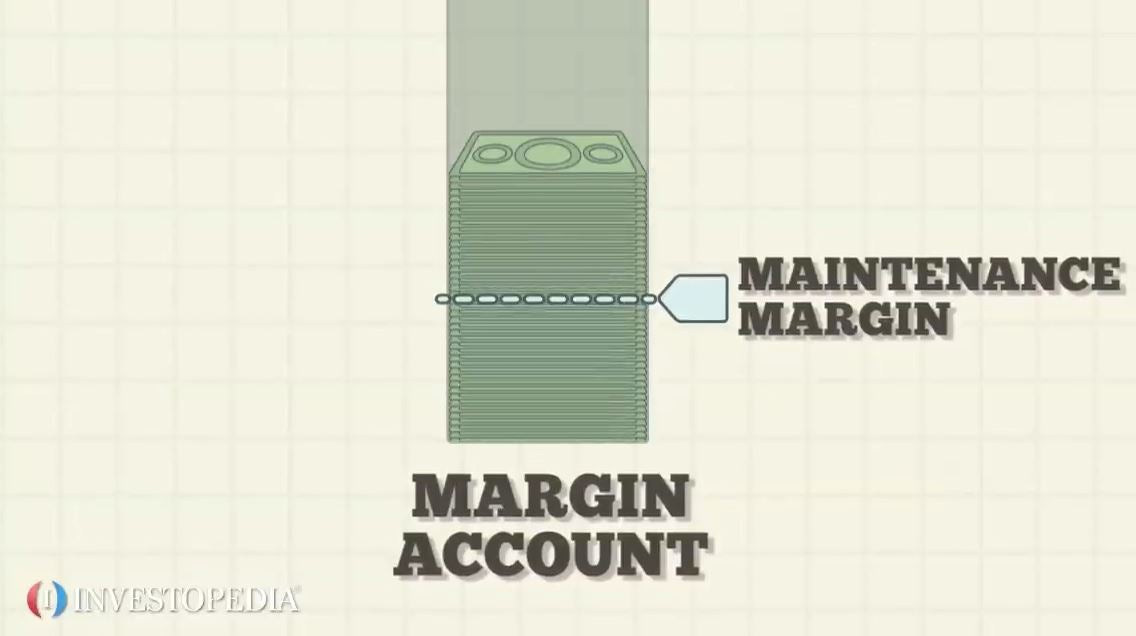

Margin is the money you contribute to buy shares on margin. Buying on margin refers to the initial payment made to the broker for the assetfor example 10 down and 90 financed. The risks of margin.

In the most basic definition margin trading occurs when an investor borrows money to pay for stocks. It is considered an advanced trading strategy considering that the. 1 Typically the way it works is your brokerage lends money to you at.

Margin trading is built on this. In stocks this can also mean purchasing. Part of the series.

The investor uses the marginable. Buying on margin allows investors to make investments with their brokers money. Buying stocks on margin requires is when an investor is granted a c.

Buying on margin. That means you are going into debt to invest. 07122022 by Financial Samurai 41 Comments.

Margin is borrowing money from your broker to buy a stock and using your investment as collateral. Investors generally use margin to increase their purchasing power. Margin stocks are any stocks that can be bought and sold on a stock exchange using funds borrowed from a broker.

Margin trading is when you buy and sell stocks or other types of investments with borrowed money. However the magnifying effect works the other way as well. When you have a relatively small amount of money to work.

Margin means buying securities such as stocks by using funds you borrow from your broker. Ad New And Experienced Investors Should Consider These Top-Recommended Brokerages. Margin trading allows you to buy more stock than youd be able to.

Investors can buy the Dow Diamonds on margin accounts which work the exact same way as with common stocks. Other fees may apply.

What Is Margin And Should You Invest On It

Comments

Post a Comment